Nvidia Ignites Stock Market with AI

The current excitement surrounding GPUs is intrinsically linked with AI development, which has remarkably altered the technology market in recent months. GPUs, or Graphics Processing Units, manage the processing and display of computer graphics and enhance the rendering speed on device screens.

American chip manufacturer Nvidia is known for its production of graphics processors, which are utilized by large language models like ChatGPT. In mid-May, the company disclosed its financial results for the first quarter of 2024 and projected its revenue for the subsequent three months.

According to their forecast, Nvidia expects its Q2 2023 revenue, ending in July, to reach a minimum of $11 billion. This projection denotes a 64% increment from the corresponding period in the previous year. Jensen Huang, Nvidia's founder and CEO, attributes this surge to the escalating demand for artificial intelligence software.

The computer industry is going through two simultaneous transitions — accelerated computing and generative AI. A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business processsays Huang

The revenue Nvidia anticipates over the next three months will surpass the company's previous quarterly record by $2.5 billion. Earlier, analysts had predicted a 30% rise in Nvidia's earnings per share over the ensuing 12 months. This forecast substantially outpaces the average 6% growth projected for a group of 11 rival semiconductor companies.

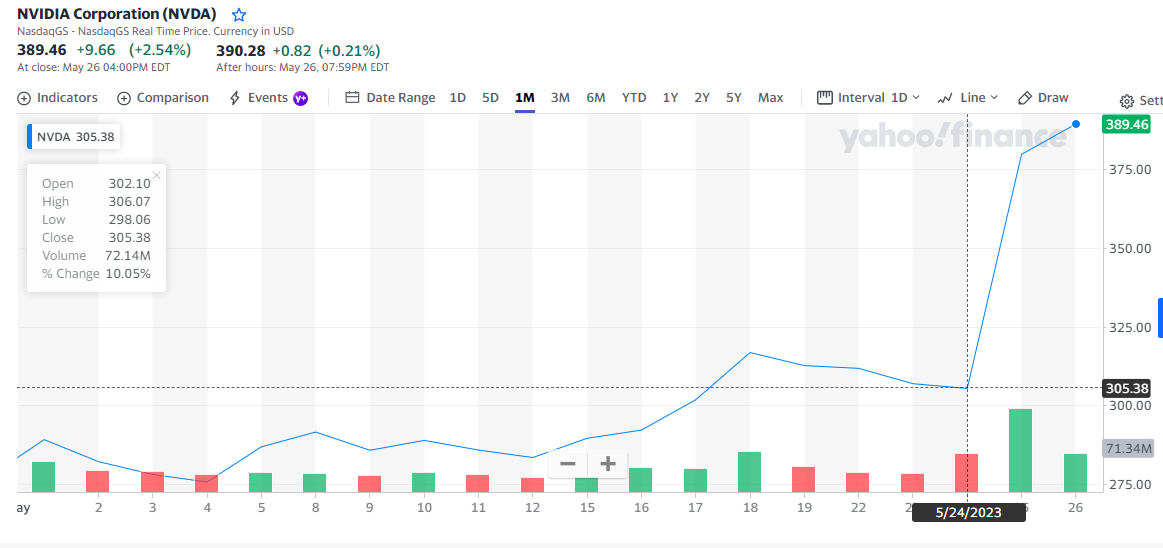

After acknowledging the significant rise in demand for data center chips, the market reacted sharply. Nvidia's stock price, which had already doubled in the past year, instantaneously leaped another 25%.

Nvidia's stock is on an upward trend following a positive financial report. Source: yahoo!finance.

The market capitalization of Nvidia, estimated at $755 billion before the release of the report, surged close to $940 billion and held at this level at the time of writing this article (end of May 2023). To put this into perspective, the one-day 1.5-fold increase in market capitalization surpassed the worth of another leading semiconductor manufacturer, Intel.

However, the question of whether the supply can meet the skyrocketing demand still remains. The primary buyers of GPUs are cloud service providers. Currently, they are encountering significant challenges trying to supply their customers with an adequate number of GPU servers. Even tech giant Microsoft is feeling the pinch of this chip shortage. Nvidia has announced that they are fully booked for the latter half of 2023. Yet, the company's management is reluctant to provide guarantees on product delivery.

Thus, today's pace of AI development is directly tied to the speed of development and production of corresponding chips. Companies engaged in this sector are faced with exciting market prospects. Oddly enough, this wasn't noticed by the renowned crypto-enthusiast and manager of ARK Innovation fund, Cathie Wood. Last summer, she purchased Nvidia shares at $182 apiece. Then, presumably deeming the company overvalued, Wood began unloading Nvidia stock from the end of October at an average price of $137, incurring a loss of approximately $45 per share. Consequently, her investors missed out on a neat sum of around $200 million in profit.

Since last fall, Nvidia's stock price has risen almost 33%. Source: yahoo!finance.